How to Register a Company in Azerbaijan: A Complete Guide

What is Company Registration in Azerbaijan?

Starting a business in Azerbaijan is an opportunity for both local entrepreneurs and foreign investors looking to enter into the country’s growing economy. One of the first and most crucial steps is company registration in Azerbaijan. The process is designed to be simple, but it requires careful attention to detail to ensure compliance with local regulations.

If you’re planning to establish a small enterprise or a large corporation, understanding the requirements and procedures for starting a business in Azerbaijan is very important. In below, we’ll explain to you everything you need to know about business registration in Azerbaijan, from the necessary documentation to the main steps involved, helping you set up your company.

Why Business Registration is Essential to Start a Business in Azerbaijan

Why Business Registration is Essential to Start a Business in Azerbaijan

Before you can begin operations, business registration is a critical step that cannot be overlooked. Whether you’re a local entrepreneur or a foreign investor, registering your company is not just a legal requirement—it’s the foundation for building a credible and successful business. Here’s why company registration in Azerbaijan is essential:

- Legal Compliance: It provides your company with a legal identity, allowing you to enter contracts, open bank accounts, hire employees, etc.

- Access to Financial Services: A registered business can easily open a corporate bank account, apply for loans, and access other financial services.

- Credibility and Trust: Registering your business makes it official and builds trust with customers.

- Tax Benefits and Incentives: Registered businesses in Azerbaijan can take advantage of the country’s tax incentives, especially in sectors like technology, agriculture, and manufacturing.

- Protection of Intellectual Property: Registering your business protects your brand name, logo, and other intellectual property, preventing others from using them without permission.

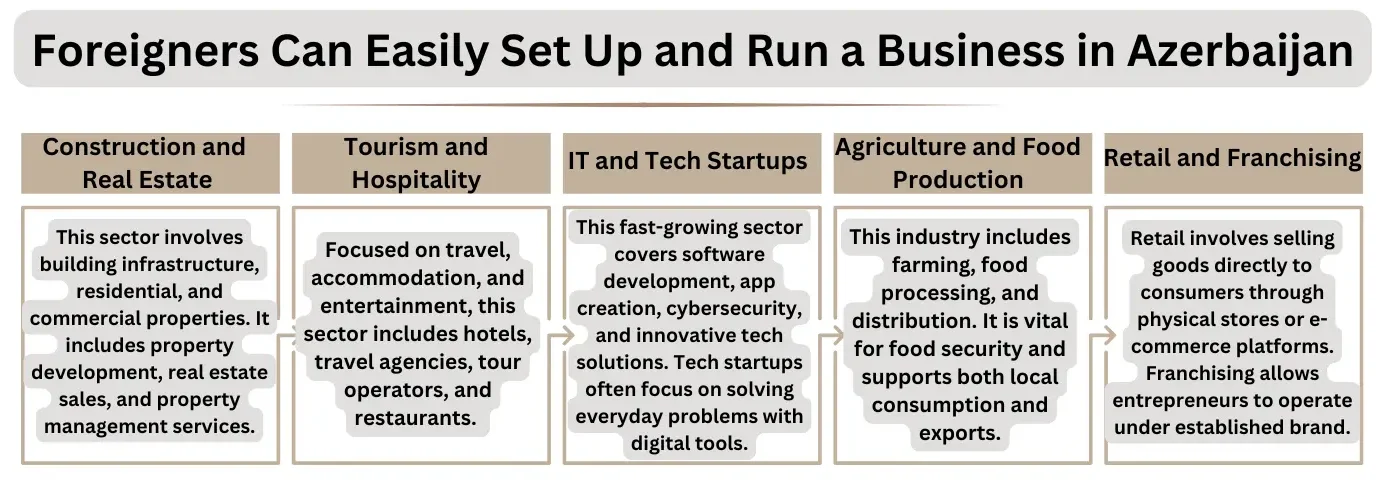

Business Foreigners Are Willing to Start in Azerbaijan

Many foreigners are eager to start businesses in various sectors, including:

- Construction and Real Estate

- Tourism and Hospitality

- IT and Tech Startups

- Agriculture and Food Production

- Retail and Franchising

Types of Business Entities in Azerbaijan

Azerbaijan offers several legal structures for business registration. Here are the most popular types:

Limited Liability Company (LLC)

- Ownership: Can be established by one or more individuals or entities.

- Liability: Limited to the shareholders’ contributions to the charter capital.

- Charter Capital: Only 10 AZN is No minimum requirement.

Joint Stock Company (JSC)

- Ideal for larger enterprises.

- Two types: Open Joint Stock Company (OJSC) and Closed Joint Stock Company (CJSC).

Individual Entrepreneur

- Suitable for a person who prefers a simple structure.

- Operates under the owner’s name without forming a separate legal entity.

Required Documents for Business Registration in Azerbaijan

To register a company, the following documents are typically needed:

- Application Form: Completed and submitted for registration.

- Power of Attorney: For legal representatives managing the process.

- Charter: Defining the company’s rules and goals.

- Company Establishment Decision: Evidence of the decision to create the business and appoint a CEO.

- Identification Documents: Copies of IDs for founders and the Director.

- Fee Payment Proof: Confirmation of state fee payment.

Subsidiary Company Registration: What You Need to Know

A subsidiary is considered a separate legal entity in Azerbaijan, although it operates under a parent company’s control. Here are the documents required for registering a subsidiary:

- Founding Company Documents: Attested registration papers of the parent company.

- Charter (Article) of the Subsidiary: Defines the subsidiary’s structure and purpose.

- Decision on Establishment: Includes details of management appointments.

- State Fee and Share Capital Proofs: Payment confirmations.

Independent Company vs. Subsidiary in Azerbaijan

Choosing between an independent company and a subsidiary is a strategic decision. Here’s a quick comparison:

Independent Company

- Operates independently with its own legal rights.

- Complete control over business decisions.

- Independent tax responsibilities.

Subsidiary Company

- Operates under a parent company’s control.

- May benefit from tax advantages depending on the parent company’s structure.

- Aligns closely with the parent company’s goals.

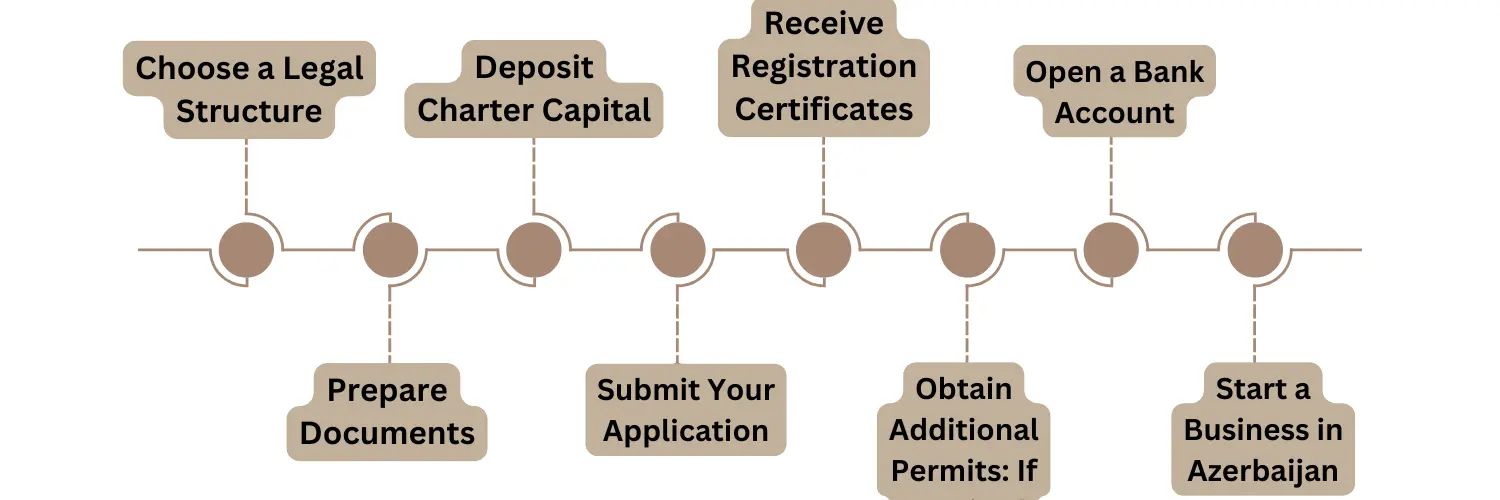

Step-by-Step Process for Company Registration in Azerbaijan

Follow these steps to register your business in Azerbaijan:

- Choose a Legal Structure: Decide whether to register as an LLC, JSC, branch, or subsidiary.

- Prepare Documents: Gather all necessary documents, including the application form and charter.

- Deposit Charter Capital: Only 10 AZN is required as charter capital for LLCs.

- Submit Your Application: File your application with the State Tax Service.

- Receive Registration Certificates: Get your Tax Identification Number and Registration Certificate.

- Obtain Additional Permits: If required for your industry, apply for additional licenses.

- Open a Bank Account: This typically takes 1–2 working days.

Registering as an Individual Entrepreneur in Azerbaijan

If you prefer a simpler structure, you can register as an individual entrepreneur. Here’s how:

- Prepare Documents: Valid ID, proof of residence, and application form.

- Submit Your Application: Visit the State Tax Service or a registration office.

- Receive Registration Certificate: This confirms your legal status as a sole proprietor.

- Open a Bank Account: Necessary for business transactions.

- Start Operations: Begin your business activities immediately after registration.

Legal Services for Company Registration in Azerbaijan

At our law firm, we specialize in helping local and foreign clients register companies in Azerbaijan. Whether you want to start a Limited Liability Company (LLC), a Joint-Stock Company (JSC), or a subsidiary, we provide full legal support from start to finish.

Below is a detailed step-by-step overview of how we help you:

1.Initial Consultation and Business Type Selection

We begin by understanding your goals.

✅ We help you choose the right business structure (LLC, JSC, or subsidiary).

✅ We explain the legal differences between each type.

✅ We advise you on what best suits your investment plan.

2.Name Check and Company Name Registration

✅ We check if your preferred company name is available.

✅ We help you register the name with the Ministry of Taxes.

3. Preparation of Legal Documents

✅ We prepare all required documents, including:

Charter (company bylaws)

Founding decision or agreement

Power of attorney (if needed)

✅ We ensure all documents meet Azerbaijani legal standards.

4. Submission to the State Tax Service

✅ We submit your application and legal documents to the State Tax Service.

✅ We handle all communication with the government on your behalf.

✅ The registration process usually takes just a three business days.

5. Obtaining the TIN (Tax Identification Number)

✅ After registration, we obtain your company’s TIN.

✅ This number is essential for tax reporting and opening a bank account.

6. Opening a Corporate Bank Account

✅ We assist you in choosing a local bank.

✅ We prepare and submit all necessary documents.

✅ We help you open your company’s bank account quickly and securely.

7. Registration for Taxes and Social Payments

✅ We register your company for VAT (if needed).

✅ We assist with registration for social and pension contributions.

8. Post-Registration Legal Support

✅ We continue to support you after registration:

Drafting contracts

Labor law advice

Compliance checks

Ready to Start Your Business in Azerbaijan?

Setting up a business in Azerbaijan is easier when you have the right support. If you want to register a company in Azerbaijan, start a business, or set up an LLC, our expert team is ready to help you at every step.

From handling legal paperwork to ensuring quick and easy business registration, we simplify the process, saving you time and effort.

Contact us today for company registration and professional support.

Related Services:

Frequently Asked Questions (FAQ)

Some profitable business sectors include:

- Tourism and hospitality

- Real estate

- IT and tech startups

- Food and beverage

- Import-export businesses

To register a company in Azerbaijan, follow these steps:

- Select a business structure (LLC, branch, subsidiary, etc.).

- Reserve a company name with the Ministry of Economy.

- Prepare and notarize required documents (charter, application, etc.).

- Submit documents to the State Tax Service.

- Obtain a TIN (Taxpayer Identification Number).

- Open a corporate bank account.

No, foreigners can own 100% of a business in Azerbaijan. A local partner is not required unless you prefer local collaboration.

Yes, if you plan to live and manage your business in Azerbaijan, you’ll need to apply for a residence permit. However, it is not mandatory if you are managing remotely.

Yes, Azerbaijan offers tax incentives for small and medium-sized enterprises (SMEs), including simplified tax regimes and reduced VAT rates in certain sectors.

While not mandatory, hiring a local accountant and legal advisor is highly recommended to navigate local laws, tax regulations, and compliance requirements.

The required documents include:

- A notarized application form.

- Founding documents (charter and shareholder agreements).

- A company name reservation certificate.

- Identification documents of shareholders and directors.

- Proof of legal address.

The registration process typically takes 2-5 business days after submitting the required documents to the State Tax Service. Delays may occur if the documentation is incomplete or requires corrections.

Yes, foreigners can register a company in Azerbaijan. They need to provide their passport, a notarized translation of the passport, and fulfill all legal requirements, such as appointing a local legal representative if needed

Azerbaijan offers a strategic location between Europe and Asia, tax incentives, a growing economy, and a supportive business environment for entrepreneurs.

To open a corporate bank account, you need:

- Business registration certificate

- TIN (Taxpayer Identification Number)

- Passport and proof of address

The cost of registering a company in Azerbaijan varies depending on the type of business structure and additional services (e.g., legal support). On average, the government fees range from 100 to 300 AZN. Additional costs may apply for notarization, translation, and consulting services.

Azerbaijan offers several benefits for businesses, including:

- Strategic location connecting Europe and Asia.

- Tax incentives in free economic zones.

- Access to diverse markets in the Caspian region.

- A growing economy with government support for businesses.

Yes, it is possible to register a company in Azerbaijan remotely by appointing a legal representative or using online services. Certain documents may still require notarization and apostille.

Common types of companies in Azerbaijan include:

- Limited Liability Company (LLC).

- Joint-Stock Company (JSC).

- Branch Office.

- Representative Office.

- Sole Proprietorship.

Professional services ensure a smooth registration process by:

- Preparing and verifying all required documents.

- Ensuring compliance with Azerbaijani laws.

- Providing legal and tax consultation.

- Saving time and avoiding errors in the registration process.